As tax season approaches, it’s important to have all the necessary forms and documents ready to file your taxes accurately and on time. In 2013, there were various income tax forms that individuals and businesses needed to fill out in order to report their earnings and deductions to the IRS.

Whether you are self-employed, a freelancer, or an employee, having access to printable income tax forms can make the filing process much easier and more convenient. In 2013, there were different forms available depending on your income level, deductions, and filing status.

2013 Printable Income Tax Forms

2013 Printable Income Tax Forms

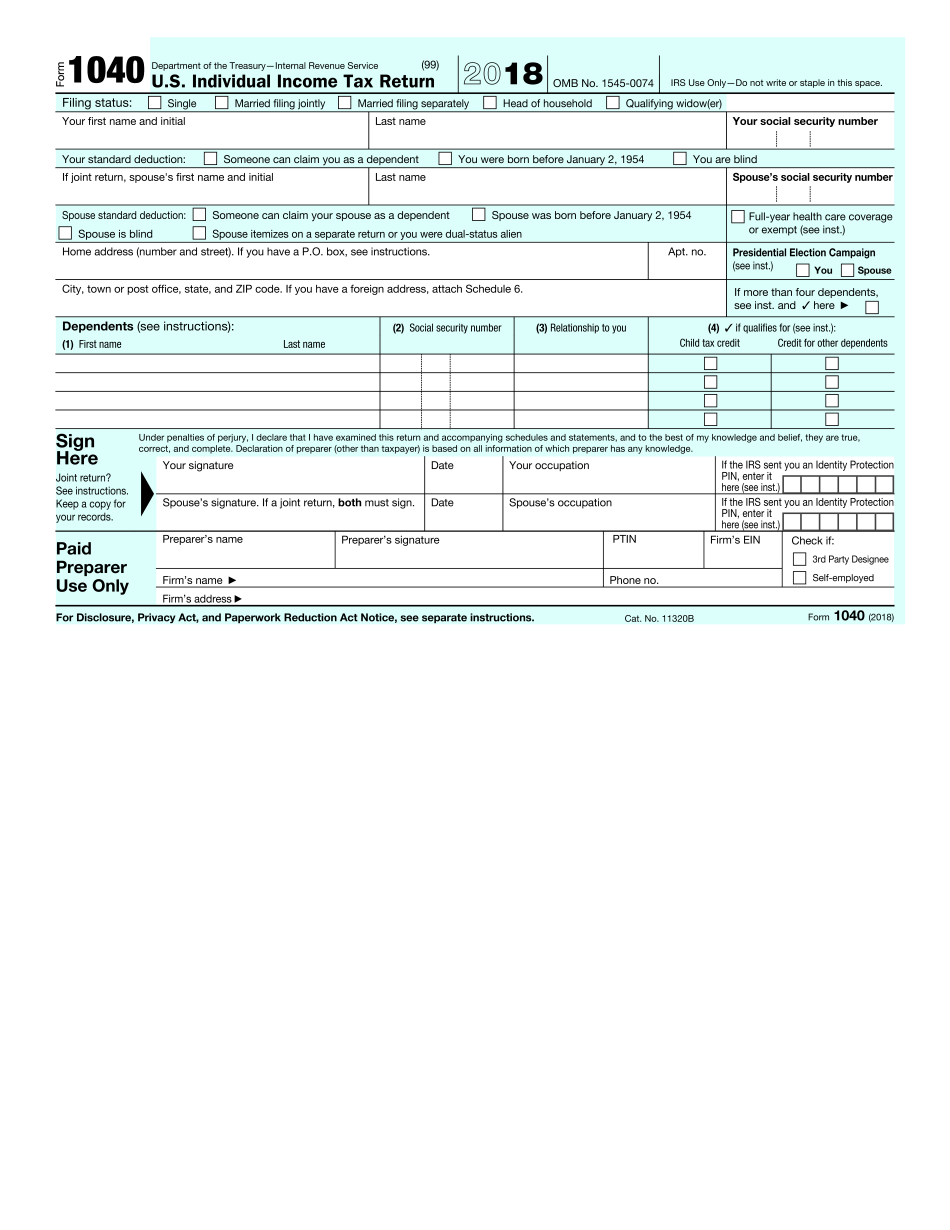

One of the most common forms for individuals in 2013 was the 1040 form, which is used to report taxable income, deductions, and credits. This form is typically used by most taxpayers and can be easily downloaded and printed from the IRS website or other tax preparation websites.

For those who had income from investments, rental properties, or self-employment, additional forms such as Schedule C or Schedule E may have been required to report this income accurately. These forms are also available for download and printing online.

It’s important to note that tax laws and forms may vary from year to year, so it’s crucial to ensure you are using the correct forms for the tax year you are filing for. By having access to printable income tax forms, you can easily fill them out at your own pace and have all the necessary information ready when it’s time to file your taxes.

Overall, printable income tax forms for 2013 can make the tax filing process more convenient and efficient for individuals and businesses. By having all the necessary forms on hand, you can ensure that you are accurately reporting your income and deductions to the IRS and avoid any potential penalties or audits.

Conclusion

Having access to printable income tax forms for 2013 can make the tax filing process much easier and more convenient. By downloading and printing the necessary forms, individuals and businesses can ensure that they are accurately reporting their income and deductions to the IRS. Make sure to use the correct forms for the tax year you are filing for and stay organized throughout the filing process.