Filing your taxes can be a daunting task, but with the help of the 1040 US Individual Income Tax Return Printable form, the process can be made much simpler. This form is used by individuals to report their annual income to the Internal Revenue Service (IRS) and determine how much tax they owe or are owed in return.

It is important to accurately fill out the 1040 form to avoid any penalties or fines from the IRS. This form covers various sources of income such as wages, salaries, tips, and investment earnings, as well as deductions and credits that can lower your taxable income.

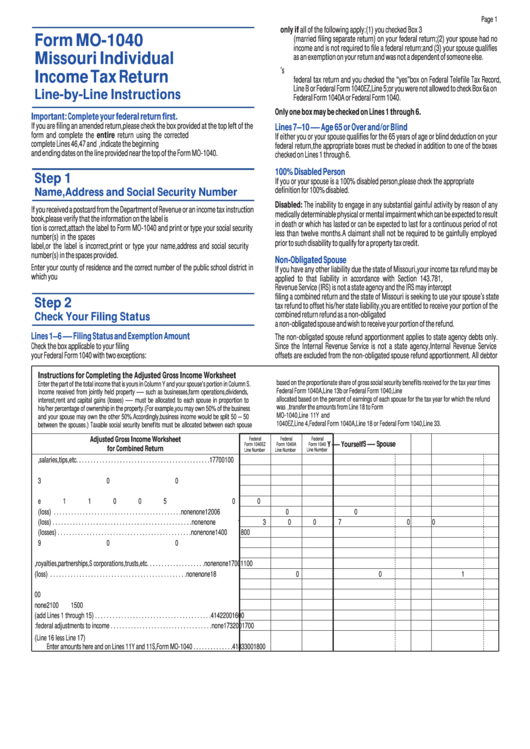

1040 Us Individual Income Tax Return Printable

1040 Us Individual Income Tax Return Printable

When filling out the 1040 form, you will need to gather important documents such as W-2s, 1099s, and receipts for any deductions you plan to claim. The form consists of several sections, including personal information, income, deductions, and credits, which must be completed carefully to ensure accuracy.

Once you have completed the 1040 form, you can either file it electronically or mail it to the IRS. If you are owed a refund, filing electronically is the quickest way to receive it. However, if you owe taxes, you may need to make a payment along with your form.

Overall, the 1040 US Individual Income Tax Return Printable form is a valuable tool for individuals to report their income and fulfill their tax obligations. By following the instructions carefully and seeking assistance if needed, you can successfully navigate the tax filing process and ensure compliance with the IRS.

Remember, it is important to file your taxes accurately and on time to avoid any penalties or legal consequences. Utilize the 1040 form to simplify the tax filing process and ensure that you meet your tax obligations as a responsible citizen.